The latest decision by the Government to slash the plug-in car grant is bad news for drivers looking to switch to electrification, but there is an even bigger elephant in the room. The really big question for electric drivers is when will free road tax end and taxes begin?

The reality is the free tax ride for electric cars won’t last forever. Independent analysis has estimated the Government are facing a loss from motoring taxes of £13 billion by 2029, as petrol and diesel cars are phased out by 2030.

![]() Taxes on EVs are inevitable to fill the hole from fuel duty

Taxes on EVs are inevitable to fill the hole from fuel duty The AA’s Edmund King has no doubt taxation is inevitable. “I think the majority of EV drivers understand a new form of taxing drivers will be needed. Taxation of electric cars is a major issue on the horizon because the Government simply cannot afford to be losing billions of pounds in tax revenue. The question is how will they do it.”

In 2019/20 motoring taxes amounted to a staggering £34 billion for the Government coffers; £27.6 billion from fuel duty and £6.8 billion from VED.

Electric car drivers currently pay zero annual road tax, while petrol and diesels driver pay bills of hundreds of pounds depending on CO2 emissions. The Government are currently assessing options after consulting with motoring organisations on how they are going to fill this growing black hole in the Treasury finances.

![Black Porsche Taycan front and left side driving]() Drivers of big petrol cars pay up to £565 per year in tax and fuel duty too. Yet the poshest electric cars go free

Drivers of big petrol cars pay up to £565 per year in tax and fuel duty too. Yet the poshest electric cars go free Governments of every persuasion have been using motorists as a cash cow for decades with every one of them raising taxation, and there is no way they won’t be taxing electric car drivers in the near future as EVs become our dominant daily transport.

The AA believe that as fuel duty on petrol and diesel cars runs dry the Government will look at a 'pay as you go' form of motoring taxation. “Alarm bells will be ringing in the Treasury because electric cars will outnumber diesel cars on the road within nine years - and new petrol and diesel cars will be banned by 2030.

"We believe any policy of road pricing could backfire as it would be seen by drivers as a poll tax on wheels. We have advocated to the Government a system of annual road miles, whereby every driver gets at least 3,000 free miles before charges are introduced.”

![Renault interior dashboard]() The AA has suggested drivers get 3,000 tax-free miles

The AA has suggested drivers get 3,000 tax-free miles The AA want to see the Government launch nationwide ‘pay as you go’ mileage trials in 2022, where the buyer of any new electric car will be charged on mileage, although they will pay no more than the current VED system.

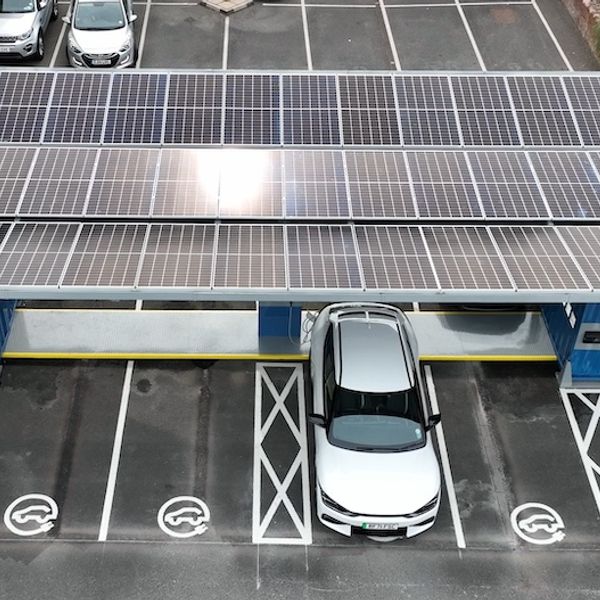

It is thought the treasury also has the technology to tax the electricity we put into our cars at home, using data collected by the chips inside every home charge unit fitted using the grant scheme and/or the smart meters which are being fitted to our homes. This has not been publicly suggested as a proposal yet, however.

The AA are also wary about escalating electricity charges at filling stations as electric cars start to dominate the roads, in the same way that petrol and diesel prices have been hiked over recent years. The Department of Transport and the Competitions & Markets Authority are already looking at pricing for electricity when on the road. There is clearly scope for an ombudsman to help keep charges at an acceptable rate.

One thing is sure drivers of electric cars are definitely facing a charge in the future.

![]() Could your home charger shop you to the tax man?

Could your home charger shop you to the tax man?  Taxes on EVs are inevitable to fill the hole from fuel duty

Taxes on EVs are inevitable to fill the hole from fuel duty

.jpg?width=45&height=45)